About Short Sales

A short sale is a property transaction where the lender will agree to take less than what is owed on the property. For the lender to agree to take less, the homeowner must supply the bank with many documents supporting loss of income and insufficient assets to pay the mortgage.

This process used to take an avarage of nine month to complete. however, with the advent of new technology the turnaround time has been shrunk in some cases to as quickly as three months or less!

The longer timeframe was turning away many qualified buyers who were not willing to wait to hear if their offer was accepted. Again, this may provide you with another opportunity if you are willing to wait and if you accept the possibility that even after waiting you might not get the property.

The biggest difference between short sales and REO properties is that with a short sale the existing homeowner still owns the property while an REO property is owned by the lender.

Don't be turned off by a property just because it is a short sale. Yes, waiting to hear if your offer is accepted will inhibit you from making other offers but you could also find that "diamond in the rough". Don't let other people's horror stories change what you think about the short sales. Many of those stories are outdated.

We are Certified HAFA Specialists and we help prevent homeowners from losing their home to foreclosure.

Too many homeowners with financial challenges fall victim to foreclosure instead of selecting and pursuing a foreclosure alternative that would better suit their families both emotionally and financially.

If you having MORTGAGE ISSUES and you're not sure what to do, call us for a FREE, no obligation appointment.

After we hear your story we will clearly break down all of your options and guide you through the next step.

We'll discuss which option is best for you

- Loan Modification - Save Your Home

- Short Sale - Save Your Credit

- Deed in Lieu Agreement - A Fresh Start

- Foreclosure - Last Resort

Click on the REO E-Book for more information about Short Sales.

Contact us today so we can help you start the process of buying or selling a Short Sale.

Tip of the Month

5 Keys to Summer ..

Sellers: Don't forget the outside. Remember, sizzle sells the steak! Know your competition. Defining your home's strengths and weaknesses against the competition is key to correct pricing. Buyers:

Don't forget the inside. The steak is only as good as the taste. Remember your goals. Do not be swayed by the large inventory of houses. Everybody: Don't be 'squeezed' by the season. With work and

vacations, the end of summer is not the end of the Real Estate selling season.

Got Questions?

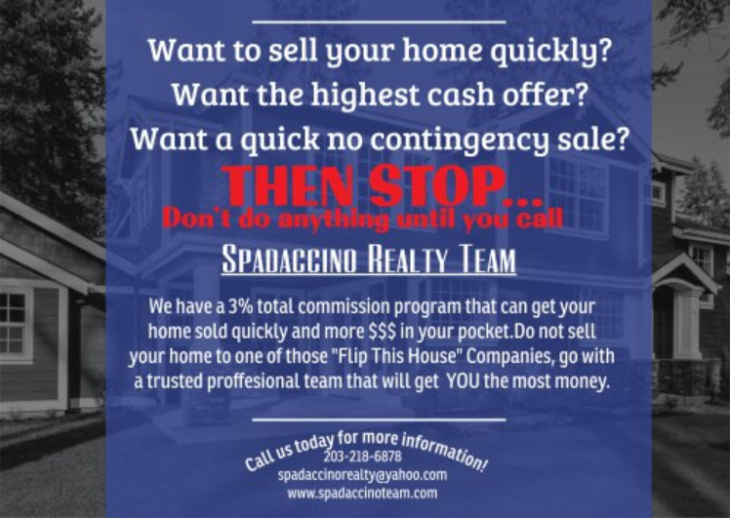

The Spadaccino Realty Team

If you have any questions, please call or email us and we guarantee a response in less than 24 hours! You can meet our brokers or stop by anytime.

1653 Capitol Avenue

Bridgeport, CT 06604

Phone: (203)368-3388

Fax: (203)368-1577

Email: spadaccinorealty@yahoo.com